Motivation: Seeing Upper Austrian B2B companies struggle in keeping up their export business intensity and simultaneously accelerating the usage of digital communication and export channels, creates the starting point for an Export Resilience study in Upper Austria, an export-oriented region. The main motivation for implementing a study in this particular field was the creation of a pool of current key findings, ring-fenced by clear managerial implications and recommendations, which respond to future export trends emerging out of the study.

Findings: An online questionnaire was sent out to exporting B2B companies which was completed by 173 respondents. The data provides insights in triggers of export resilience, insight in future export channels and differences in the export strategy of Upper Austrian B2B companies. For example, the survey has shown that 52% of the participating businesses can be classified as being „immune” to external influences. Further insights are given according to the change of digital export tools, the form of meetings and AI based export tools.

Conclusion: Consequently, the extent to which the implementation of the export resilience study stimulated the dialogue between the academic and business community led to managerial recommendations for Austrian B2B export companies.

1 Introduction

For a long period of time, the Upper Austrian economy has performed extraordinarily well in comparison to other similar regions. Even though Upper Austria is home to only 16.7% of the Austrian population (Statistik Austria 2021), Upper Austrian companies create 25.4% of total Austrian exports. The export quota of Upper Austria (57.7%) is almost 20% higher than the Austrian average, putting itself in the top field also in an international comparison (Austrian Economic Chambers 2019). Therefore, it makes sense to analyze the behavior of these companies in order to secure this business also for the future. Especially in the current COVID-19 crisis, the flexibility paired with the robustness of a business can play a decisive role. The Austrian Institute of Economic Research (2020) has recorded a decrease in total export of 11.6% compared to 2019 while the total GDP shrank by only 7.3%, indicating that export is especially volatile in the event of a global crisis. However, the Austrian Institute of Economic Research also expects the export business to grow faster than total GDP for the next two years (+5.2% vs. +4.5% for 2021, +7.3% vs. +3.5% for 2022). This implies that it is particularly important to help the more volatile exporting business overcome crises as well as possible to keep also changes in total GDP at a minimum.

In the past, resilience has been understood as the ability to avoid or reduce risks that are presented by specific events in order to get back to the same state as before the shock as soon as possible. However, it is increasingly suggested to also interpret it as the ability of an organization to remain robust and flexible in an uncertain environment to develop further possibilities for growth. Following this interpretation, a crisis is not only considered to pose a threat to the organization, but also to offer the possibility to develop the necessary skills to be successful in a rapidly changing environment. Steccolini, Jones and Saliterer (2017) identified four major action and ability dimensions that distinguish resilient businesses:

- Resilient businesses have a clear understanding of their surroundings to recognize chances and risks as soon as possible and to develop measures to optimize the impact a certain development has on the business.

- Resilient businesses show a particularly high degree of robustness in the anticipation and puffer period of an upcoming crisis which is marked by a proactive approach to develop solutions.

- The recoverability describes the ability of an organization to adapt to a new environment after a crisis. Resilient businesses therefore find a way to integrate new, robust processes into the existing structures.

- To be more resistant in an unstable environment, resilient businesses do not hesitate to think of new, more effective ways to solve a problem even if that means to abolish existing ways of working. This flexibility can be a decisive element in the strategy of a business (Steccolini, Jones and Saliterer 2017).

Morisse and Prigge (2017) developed a practice-oriented model of resilience for businesses in the Industry 4.0 manufacturing industry to illustrate the necessary components of transforming into a more resilient business. The following six components have been identified:

- Understanding the environment: Businesses should be aware of the current situation and recognizing trends as early as possible.

- Understanding the own system: Businesses should be aware of the company culture and values and how changes might be perceived.

- People: Businesses should have people with the right personality type (who are acting in favor of resilience proactively).

- Processes: Connected to the first component, processes need to be continuously adapted to the current environment.

- Technology: New technologies are developed to increase the efficiency of processes and are therefore supportive of reaching business resilience.

- Information: In times of Big Data, as much data as possible should be processed and used in order to predict upcoming changes (Morisse and Prigge 2017).

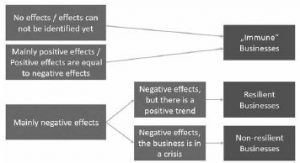

Reflecting existing literature, authors use the definition of resilience from Flüter-Hoffmann, Hammermann and Stettes (2018) which is depicted in figure 1. According to this definition, those companies, which are not affected by a crisis, or those for which the positive effects are at least as strong as the negative effects are known as „Immune Businesses”. Companies that are negatively affected by the crisis but are experiencing an upward trend are called „Resilient Businesses”. Consequently, the ones that are negatively affected and do not see any improvement in the near future are „Non-resilient businesses”. The Institute of the German Economy published both, the theoretical concept and the empirical study on individual and organizational resilience (Flüter-Hoffmann, Hammermann and Stettes 2018). Using this classification of businesses regarding their responsiveness to external influences, the study investigates the resilience of Upper Austrian businesses in the case of the current COVID-19 crisis.

Figure 1: Classification of businesses regarding their degree of resilience

Source: adapted from Flüter-Hoffmann et.al. (2018)

2 Methodology

In order to gather insights from Upper Austrian companies regarding their performance during the COVID-19 crisis as well as their export performance in general, an online survey was designed and distributed to a total of 3.755 different recipients on November 20th, 2020 using two separate internal databases. After using two additional reminders (December 3rd,2020 and January 19th, 2021) to increase the number of respondents, the questionnaire was filled out by 172 sales or export managers, resulting in a response rate of approximately 4.6%.

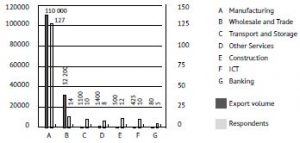

Rather than displaying the structure of the entire Austrian economy, the authors decided to focus on exporting business-to-business (B2B) companies. As represented in figure 2, the distribution of the total number of respondents of this survey fits the relative monetary export volume of each sector (based on total Austrian exports) relatively well.

Figure 2: Structure of respondents vs. relative export volume

Source: Statistik Austria (2020)

The questionnaire consisted of eight statistical questions as well as 34 content-related questions. These content-related questions were split up into the following categories:

- General resilience of the business (6 questions)

- Resilience of the business regarding export (4 questions)

- Handling of export markets in general (7 questions)

- Market analysis in export countries (2 questions)

- Sales in export countries (6 questions)

- Market communication in export countries (6 questions)

- Business models (3 questions)

The main part of the survey consisted of quantitative questions. Moreover, four open questions distributed evenly in the categories allowed the respondents to give additional statements and insights into their business.

For the interpretation of the results, the authors focused on descriptive statistics in the first part. To identify dependencies between the participants’ responses in terms of resilience in general as well as in an export context, chi-squared tests were performed in a second step.

3 Findings

3.1 The resilience of export-oriented Upper Austrian businesses

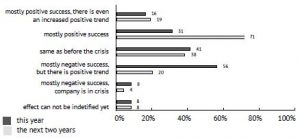

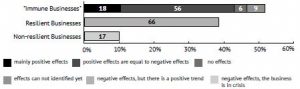

Referring to the previously introduced definition from the Institute of German Economy Cologne (2018), the participants were asked about the effects COVID had on their company. Using the same classification, it can be said that about 52% of the participating businesses are „immune” to the current crisis, meaning that they were not negatively influenced. 38% of the businesses have experienced negative effects but can feel a positive trend, which makes them „resilient businesses” according to the definition. Only about 10% of the businesses are classified as non-resilient businesses, meaning that they are still in a crisis triggered by COVID-19. These findings are illustrated in detail below.

Figure 3: Resilience of export-oriented Upper Austrian businesses

Source: Authors

3.2 The reaction of export-oriented Upper Austrian businesses to the COVID-19 crisis

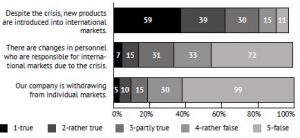

Upper Austrian businesses turn out to be relatively robust in the current crisis. About 63% of the respondents indicated that the introduction of new products to international markets is not affected by the crisis. At the same time, the participating companies seem to be stable in terms of keeping personnel and staying in international markets. Only 14% intend to make changes in terms of the personnel who are responsible for international markets while less than 10% intend to leave certain markets due to the crisis. This trend might be an indicator for the businesses’ awareness about the need to invest resources in foreign markets even though they might not be profitable at the moment in order to be in a strong competitive position once the crisis is over.

Figure 4: Reaction of Export-oriented Upper Austrian Businesses to the COVID-19 crisis

Source: Authors

3.3 Export business success of Upper Austrian companies

As for all crises, the current COVID-19 situation brings upon businesses a particularly challenging amount of uncertainty. Therefore, the respondents were asked how successful they would expect the business to be for this year as well as for the next two years respectively.

What can be observed is that the COVID-19 crisis led to a negative development for many companies. However, a positive trend is noticeable which will intensify over the next two years. In contradiction to figure 3, where the effects of the COVID-19 crisis were illustrated, figure 5 shows an estimation of the business success.

Figure 5: Reaction of export-oriented Upper Austrian businesses to the COVID-19 crisis

Source: Authors

3.4 Findings from open questions

The research identified, among others, two main strategic streams where companies tried to reach a higher level of Export Resilience by focusing on Digitalization and Artificial Intelligence (higher efficiency and customer readiness) and simultaneously minimizing risk and discovering new opportunities by developing market entry strategies for new regions. Four open questions provided an in-depth view bouncing around those described, critical influential factors for an optimized export resilience.

- Digitalization and AI

The core of 69 respondents indicated a clear acceleration on utilizing digital tools in export for an improved response and cost-efficient communication between the export partners and the final customers. This enables faster feedback, higher decision rates and let overall service costs drop, with a focal point on reduced business trips of Technical Service and Export Managers. Next to the classical digital Technical Services, instruments like remote and pro-active maintenance, more and more commercial tools like virtual negotiation platforms or VR- Gadgets for negotiations and pinpointing on USPs are emerging. This virtual Export Marketing Mix is rounded up by digital in-house fairs, especially focused on the Asian area, intense web shop offerings and home office systems. On the HR dimension some companies try to upgrade their sales partners by continuous online sales trainings and full CRM integration of indirect sales channels like distributors or agents.

35 respondents put their digital export resilience focus on cross-linked, digitalized processes like CRM, EDI and PDM/PLM systems, which lead to a seamless and fully integrated end-to-end sales and operation planning from end-customers to export partners and Austrian producers. Digitalized prospect to cash processes within the total export value chain are also contributing to an optimized export resilience.

The third export digitalization cluster where companies intensified their strategic maneuvers for boosting exports deals with classical remote services, utilizing VR and AR tools and finally heads for a better on-line integration into production processes with Internet of Things or Industry 4.0.

- Future export countries to serve

In order to increase risk minimization, two continents were mentioned prominently: Africa (in particular South Africa, Tunisia and Morocco) and South America. However, no clear answers were provided regarding a more country-specific market entry strategy, compensating for the higher macroeconomic volatility those continents show.

Those two strategic export resilience factors on the revenue side were also combined with continuous cost optimization, stringent cash flow monitoring and a solid financial treasuring strategy.

3.5 Discovered dependencies

As mentioned before, Chi-squared tests are conducted to identify dependencies between the way businesses operate and their degree of resilience. Those questions with relevance in the field of resilience have been tested against each other. As a result, the following hypotheses are rejected:

- H0: The region in which the competitive pressure is most noticeable is independent of the performance of the sales strategy. (p=0.041 à H0 is rejected)

- The sales strategy of the participating businesses seems to work especially well for those who have their main competitors outside of Europe. Respectively, those who have their main competitors in Europe are more likely to struggle with their sales strategy.

- H0: Whether the company leaves individual markets is independent of the performance of the sales strategy. (p=0.045 à H0 is rejected)

- Companies, whose sales strategy perform better, are more likely to stay in their markets than those with unsatisfactory sales strategies.

- H0: Whether the export risk has increased in regions particularly affected by Covid-19 is independent of the degree of implementation of digital lead generation. (p=0.039 à H0 is rejected)

- Companies, which have not yet implemented digital lead generation, are more strongly influenced by the travel restrictions than those who have, since those companies perform their customer acquisition process digitally to a large extent.

- H0: Whether the company leaves individual markets is independent of the effects Covid-19 had on the business. (p=0.041 à H0 is rejected)

- Companies, which are classified as „immune”, tend to stay in the business while non-resilient companies are more likely to leave individual markets.

- H0: Whether new products are introduced to international markets is independent of the effects Covid-19 had on the business. (p=0.044 à H0 is rejected)

- Companies, which are classified as „immune”, tend to introduce new products to international markets while non-resilient companies are more likely hesitate.

- H0: Whether there are changes in the export partners due to the crisis is independent of the effects Covid-19 had on the business. (p=0.031 à H0 is rejected)

- Companies, which are classified as „immune”, tend to keep their export partners unchanged while the resilient businesses (those who were negatively influenced but are feeling a positive trend) are more likely to change their export partners.

- H0: The expected business success for the next two years is independent of the effects Covid-19 had on the business. (p=0.014 à H0 is rejected)

- Companies, which are classified as „immune”, expect a positive business success for the next two years, while non-resilient companies expect the success to be mostly negative.

4 Managerial implications

Summarizing the key findings and identified dependencies, those Austrian companies enjoy a stronger export resilience and profitability, which:

- Combine robustness factors (as indicated in chapter 3.4.) like sufficient cash, cost leadership, superb new customer opportunity management with flexibility parameters like scenario planning techniques, using AI for drip campaigns, virtual negotiations, which results in magnificent outpacing response times towards their international customers.

- Consistently upgrade their international direct and indirect sales force utilizing also digital communication tools like online sales trainings and having implemented sales enablement.

- Equips on top their world class export team with integrated, digital and AI supported tools, with the final purpose to achieve an integrated end-to-end planning and execution process driven by instant digital and AI-supported customer responsiveness. These AI-supported and digital tools must be ring-fenced by creating a digital culture and acceptance for all involved the Export participants.

- Individualize and customize their export products and services better and quicker than competition.

5 Survey results versus theoretical hypotheses

The key findings of this research confirmed overall the Resilience hypotheses from Steccolini, Jones and Saliterer (2017). A detail the following can be stated:

„Resilient businesses have a clear understanding of their surroundings to recognize chances and risks as soon as possible and to develop measures to optimize the impact a certain development has on the business.”

- Confirmed, as those companies which have clear understanding of existing but especially new markets to be entered, minimize their Export Risk. The higher the new customer knowledge is, the lower is their risk level, simply by generating more opportunities. A clear measurement and utilizing new digital Tools for KPIs and measurements accelerates this dynamic.

- Also, the first dependency emerging from chapter 3.5 confirms above mentioned hypothesis. The better the sales strategy understanding in terms of customer\regional, product and innovation mix and its sales strategy execution, the higher the export resilience.

„Resilient businesses show a particularly high degree of robustness in the anticipation and puffer period of an upcoming crisis which is marked by a proactive approach to develop solutions.”

- The survey confirms that a high degree of innovation capability and execution for the well-defined export regions create a certain level of robustness. Particularly successfully launched products with a certain differentiation potential create a more constant buying pattern throughout the CoVid19 crisis.

- Furthermore, those companies, which had not a standard linear budget setting and operated rather with scenario techniques, thus had crisis scenarios in their drawer, were capable to maintain a pro-active approach and limiting the revenue decreases.

- The third dependency of chapter 3.5. confirms also the hypothesis, as companies who established digital tools and channels before the crisis, could easily switch proactively to a continuation of customer coaching and business overall.

„The recoverability describes the ability of an organization to adapt to a new environment after a crisis. Resilient businesses therefore find a way to integrate new, robust processes into the existing structures.”

- 35 respondents confirmed the implementation of and adaption to digital Export Processes, like digital sales acquisition tools (e.g.: oneflow.com), fully integrated end to end planning processes throughout the value chain network and web-based communication tools with their customers.

„To be more resistant in an unstable environment, resilient businesses do not hesitate to think of new, more effective ways to solve a problem even if that means to abolish existing ways of working. This flexibility can be a decisive element in the strategy of a business.”

- The degree of innovativeness outside the product focus confirms the above-mentioned hypothesis. Entities, which were searching and implementing alternative logistic chains at an early stage and used digital communication tools proactively had less impact on their business.

- Dependency 4 of chapter 3.5 confirms the hypothesis as well: Companies, which are classified as „immune”, tend to stay in the business while non-resilient companies are more likely to leave individual markets.

6 Future research

To monitor the performance of the participating companies also in the long run, the authors suggest a longitudinal research design. This would also make it possible to investigate how certain trends, such as digitalization and globalization, evolve over time and are adopted by an increasing number of businesses.

Furthermore, expanding the study to an international format would deliver additional insights regarding the level of resilience of different regions and countries.

Up to now, only internal data collected by interviews with sales and export managers are used as the source of information. Obviously, this leaves some space for interpretation. For future research, it could therefore be interesting to combine collection of external data with self-reflective data on the resilience of businesses.

Literatúra/List of References

- Austrian Economic Chambers, 2019. Exportstandort OÖ. 2019. [online]. [cit. 2021-03-21]. Available at: <https://www.wko.at/site/export-center-ooe/exportstandort-ooe.html>

- Austrian Institute of Economic Research, 2020. WIFO-Konjunkturprognose. 2020. [online]. [cit. 2021-03-22]. Available at: <https://www.wifo.ac.at/wwadocs/konjunktur/Prognosen/WIFO-Konjunkturberichterstattung_Prognose_Hauptergebnisse.pdf>

- Flüter-Hoffmann, Ch., Hammermann, A. and Stettes, O., 2018. Individuelle und organisationale Resilienz. In: Forschungsberichte aus dem Institut der Deutschen Wirtschaft. Institut der Deutschen Wirtschaft, eds. Cologne, IWMedien. 2018, 127, 1-89. 2019. [online]. [cit. 2021-03-21]. Available at: <https://www.iwkoeln.de/fileadmin/user_upload/Studien/IW-Analysen/PDF/2018/Analyse_127_Individuelle_Resilienz.pdf>

- Statistik Austria, 2020. Außenhandel nach Wirtschaftszweig (NACE): Berichtsjahr 2018. 2020. [online]. [cit. 2021-03-21]. Available at: <http://www.statistik.at/wcm/idc/idcplg?IdcService=GET_NATIVE_FILE&RevisionSelectionMethod=LatestReleased&dDocName=111315>

- Statistik Austria, 2021. Übersicht der Bundesländer. 2021. [online]. [cit. 2021-03-22]. Available at: <http://www.statistik.at/web_de/klassifikationen/regionale_gliederungen/bundeslaender/index.html>

- Steccolini, I., Jones, S. D. M. and Saliterer, I., 2017. Introduction: Governments and crises. In: Governmental Financial Resilience. Perspectives on How Local Governments Face Austerity, Steccolini, I., Jones, S. D. M. and Saliterer, I., eds. New York, Emerald. 2017, 27, 1-16. DOI: 1108/S2053-769720170000027001

- Morisse, M. and Prigge, C., 2017. Design of a business resilience model for industry 4.0 manufacturers. 3rd Americas Conference on Information Systems (AMCIS 2017): A Tradition of Innovation, Association for Information Systems, eds. Boston, Massachusetts, Association for Information Systems, 2017, 23, 2929-38. [online]. [cit. 2021-03-22]. Available at: <https://core.ac.uk/download/pdf/301371962.pdf>

- Manzitti, V., 2016. Bringing intercultural competence to development. 2016. [online]. [cit. 2019-11-17]. Available at: <https://europa.eu/capacity4dev/article/bringing-intercultural-competence-development>

Kľúčové slová/Key words

export, export resilience, digital communication, Upper Austria, sales management, B2B companies

export, odolnosť voči exportu, digitálna komunikácia, Horné Rakúsko, riadenie predaja, B2B spoločnosti

JEL klasifikácia/JEL Classification

M21, M31, O33

Résumé

Odolnosť exportu – budúci kľúčový faktor úspechu pre hornorakúske B2B spoločnosti?

Motivácia: Vidieť hornorakúske B2B spoločnosti bojovať pri udržiavaní ich vývoznej intenzity podnikania a súčasne urýchliť používanie digitálnej komunikácie a vývozných kanálov, vytvára východiskový bod pre štúdiu pružnosti vývozu v regióne Horného Rakúska, regióne zameraného na vývoz. Hlavnou motiváciou pre uskutočnenie štúdie v tejto oblasti bolo spracovanie súčasných kľúčových zistení s jasnými manažérskymi dôsledkami a odporúčaniami, ktoré reagujú na budúce vývozné trendy, vyplývajúce z tejto štúdie.

Zistenia: Online dotazník bol zaslaný vyvážajúcim B2B spoločnostiam, z ktorých 173 sa zapojilo do prieskumu. Údaje poskytujú postrehy v spúšťačoch vývoznej odolnosti, pohľad na budúce vývozné kanály a rozdiely vo vývoznej stratégii hornorakúskych B2B spoločností. Napríklad prieskum ukázal, že 52% zúčastnených podnikov možno klasifikovať ako “imúnne” voči vonkajším vplyvom. Ďalšie postrehy sú uvedené podľa zmeny nástrojov digitálneho exportu, formy stretnutí a vývozných nástrojov na základe AI.

Záver: V dôsledku toho, do akej miery štúdia implementácie odolnosti vývozu stimulovala dialóg medzi akademickou a podnikateľskou komunitou, viedla k manažérskym odporúčaniam pre rakúskych B2B exportérov.

Recenzované/Reviewed

25. March 2021 / 29. March 2021