1 Background: Live stream commerce prevalent but research gap remains large

Live Stream Commerce (LSC), a subset of social commerce that facilitates real-time product showcases, purchasing, and interactions during live streams, is rapidly gaining traction globally. LSC leverages social media, influencers, and interactive formats, growing in popularity on platforms like Amazon, Taobao, TikTok and Facebook (Robertson 2022; Wongkitrungrueng and Assarut 2020).

Taobao, a frontrunner in China’s e-commerce sphere, adopted LSC in 2016, combining entertainment with on-the-spot purchasing and heavily promoted the format (AliResearch 2018). By 2018, over 80 Taobao stores were earning in excess of $7.4 million each through LSC (Hallanan 2019), and nearly half of China’s internet users, accounting for 469 million, were LSC consumers (CCPIT 2022). This boom has led global brands to tap into Taobao for a variety of events and sales. LSC has reshaped retail in China, transforming customer-brand dynamics and significantly enhancing sales. The model is spreading in the U.S. and Europe, indicating its potential to reshape global retail (Becdach et al. 2023). Recognizing its potential, e-commerce giants and major brands like L’Oréal, P&G, Nike, UNIQLO, and Cartier are deploying similar services. Amazon, for instance, partners with personalities like influencer Paige DeSorbo for live streams, enabling real-time viewer interaction and immediate purchases (Holman and Huang 2023). In the U.S., LSC sales are estimated to reach $17 billion in 2022, with expectations to triple in the coming years (Chevalier 2022a).

LSC has quickly gained prominence through a unique fusion of features distinct from traditional retail models. Unlike conventional online retail, LSC leverages live video to display products, offering consumers insights and the opportunity for instant queries and responses, delivering a personalized experience (Wongkitrungrueng and Assarut 2020). Each LSC event creates urgency, often presenting exclusive, time-sensitive offers that drive consumer interest and actions (Li et al. 2022). This tactic is similar to pop-up stores, which are effective at stimulating consumer curiosity and purchase intentions (Rosenbaum, Edwards and Ramirez 2021). Additionally, LSC fosters parasocial relationships between streamers and viewers, significantly impacting their purchasing choices (Turits 2023). Notably, LSC reports conversion rates as high as 30%, substantially outperforming traditional e-commerce (Arora et al. 2021).

In 2021, Taobao led China’s LSC market with a 37.8% share, while TikTok followed closely at 33.8% (Statista 2022). In the United States, Facebook, Instagram, TikTok, and Amazon were key players in 2022, with Facebook leading at 26% (Statista 2023). Globally, the most utilized LSC platforms were Facebook, Instagram, TikTok, and YouTube, as indicated by Bazaarvoice (2022). The global landscape of LSC showcases a diverse range of popular platforms. Facebook, Instagram, Taobao, and TikTok lead the market, each representing different segments. Taobao and Amazon are prominent in the e-commerce sector, while TikTok specializes in short-form video content. Social networking sites like Facebook and Instagram have also carved out significant spaces in the LSC arena. This diversity reflects the multifaceted nature of LSC, encompassing various forms of digital interaction and commerce.

LSC is an application of Web 2.0, utilizing social media for innovation (Diedrich, 2017). Scholars like Guo et al. (2021) view LSC from an e-commerce lens, highlighting its blend of live streaming and social interaction, enhancing the consumer experience. On the other hand, Wongkitrungrueng and Assarut (2020) consider it a facet of social commerce, focusing on the integration of commerce into social networks. Generally, academic definitions of LSC acknowledge its hybrid nature, combining various technologies. Research in LSC typically revolves around three main themes. The first theme, analyzed by Zhang et al. (2022) and Chen et al. (2022), delves into trust and engagement, emphasizing the role of interactivity and the influence of streamers in building trust. The second theme, studied by Gao et al. (2018) and He et al. (2023), focuses on how telepresence and social interaction affect viewer behavior and community engagement. The third theme, explored by Sun et al. (2019), Park and Lin (2020), and Zhang et al. (2020), examines the factors influencing purchase decisions, including IT affordances and psychological strategies. These studies collectively underscore the technological and psychological dimensions of LSC and their impact on consumer behavior.

While much of the existing LSC research provides valuable insights, it often misses key aspects that define the unique nature of LSC. For instance, the literature tends to overlook the significant differences among the three main types of LSC platforms, which include their market position, offered services, user demographics, target customers, and motivations for usage. These factors lead to varied behaviors in viewing and purchasing via live streaming Wongkitrungrueng and Assarut 2020). Users of dedicated shopping apps usually have a pre-established shopping intent, contrasting with users on social and short-form video platforms who might not initially plan to shop (Xue and Liu 2022). Recognizing these distinctions is crucial, as they influence different customer journeys and decision-making processes. However, much of the current research approaches LSC as a homogeneous entity, blending these diverse aspects and potentially leading to conclusions that don’t fully align with the complex realities of LSC.

A substantial amount of LSC research has been published, but a significant research gap remains unaddressed. This gap pertains to the lack of clarity around the different LSC platforms and the motivations and behaviors of their users (Xue and Liu 2022). Without distinguishing these aspects, it becomes challenging to delve into the essence of LSC and make practical contributions. Therefore, this study aims to start from a practical standpoint and propose a strategic analytical framework. This framework will clearly articulate the phenomena, characteristics, participants, and operational methods of LSC, providing a correct direction for future research and serving as a reference for academics and managers.

2 Methodology and aim of article

This study aims to fill the current gaps in Live Stream Commerce (LSC) research by delving into the diverse range of LSC platforms and exploring user motivations and behaviors within these platforms. In our research, we adopt a multifaceted approach that integrates participant observation and comprehensive literature review. This method allows us to gather both empirical insights and theoretical perspectives on LSC. Since 2020, we have actively participated in LSC as members on various major platforms, including emerging ones like Taobao and TikTok in Taiwan. Our involvement wasn’t limited to observation; we actively engaged in both buying and streaming. This dual role as streamers and viewers provided us with a unique understanding of LSC’s operational aspects, including pre-live stream preparations, content development, product supply management, and logistics. During this period, we conducted over 24 hours of live stream sales and purchased approximately 22 items as viewers, thus experiencing LSC’s dynamics firsthand.

The methodology of combining participant observation with a comprehensive literature review is highly suitable for studying LSC. Participant observation, as supported by Kawulich (2005), is a key method in qualitative research that allows for an immersive understanding of the subject matter from within. This method facilitates firsthand experience and observation, providing valuable insights into user behavior and platform dynamics. Furthermore, the integration of a broad literature review complements these observations with theoretical perspectives, ensuring a well-rounded analysis. This approach aligns with the recommendations of Musante and DeWalt (2010), who emphasize the importance of contextual understanding in research, which participant observation effectively provides. This combination offers a holistic view of LSC, capturing both empirical realities and theoretical constructs.

3 Framework of LSC

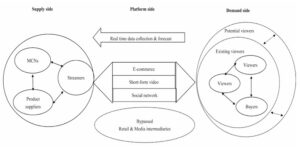

The technological infrastructure of platforms is crucial to LSC, enabling innovative interactions and transactions vital to retail success. This framework centers on the platform aspect of LSC, supported by three main pillars: e-commerce, short-form video, and social network – essential elements of LSC. It delineates the LSC Supply Side, comprising Streamers, Multi-channel Networks (MCNs), and Product Suppliers, on one flank, and the LSC Demand Side, which includes both viewers and purchasers, on the other—recognizing the distinction between viewing and buying behaviors (see Figure 1).

Figure 1: Framework of LSC

Source: Author

3.1 Evolution and classification of LSC

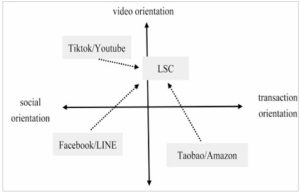

According to statistics, the world’s major LSC platforms include Facebook, Instagram, TikTok, and YouTube globally, with Taobao and TikTok leading in China, and Facebook, Instagram, TikTok, and Amazon being popular in the U.S. (Statista 2022, 2023; Bazaarvoice 2022). These figures reflect the unique features and market dynamics of LSC platforms in different regions. Based on these insights, we propose a model for LSC platform maturity using two axes: video versus text/image orientation, and transaction versus social orientation, classifying the platforms into three distinct categories, as illustrated in Figure 2:

(1) E-commerce driven LSC: As mentioned by Chen, Zhao and Wang (2022), Xue and Liu (2022), and Wongkitrungrueng et al. (2020), e-commerce websites such as Taobao, Amazon, and Shopee have integrated live streaming features, allowing sellers to sell products through live streaming. These platforms have an existing product display, shopping cart, product, member database, payment, and logistics functions, which makes it easy for sellers to fulfil orders during live streaming.

(2) Short-form driven LSC: Platforms like TikTok and Kuaishou, which focus on short videos, have introduced live streaming channels and added shopping cart, payment, logistics, and transaction database functions. While other scholars classify these as social live streaming platforms (Chen, Zhao and Wang 2022; Wongkitrungrueng, Dehouche and Assarut 2020; Xue and Liu 2022), we separate them due to the unique algorithms and business models that significantly impact live streaming sales (Chen and Shi 2022; Kočišová and Štarchoň 2023).

(3) Social driven LSC: Social platforms like Facebook, Instagram, Weibo, and LINE have introduced live streaming channels, but lack integrated e-commerce features. While transactions on platforms like LINE can be directly completed, Facebook and Instagram need third-party supportto facilitate transactions through keyword capturing and order detail processing. Despite not being able to complete transactions within the same system, the Facebook LSC model remains the predominant transaction model in Taiwan and Southeast Asia (Wongkitrungrueng and Assarut 2020).

Figure 2: Development paths of the three types of LSC platforms

Source: Author

3.1.1 LSC on e-commerce platforms

E-commerce platforms are inherently transactional, providing comprehensive services like product listings, shopping carts, user databases, payment processing, and logistics to facilitate live stream purchasing. They are less focused on social and entertainment aspects, attracting users who are primarily interested in shopping. This has shaped the trajectory of LSC’s evolution on such platforms.

Amazon labels its LSC as „Shoppable video“ prominently displayed on the Amazon Live logo. In the 2021 and 2022 Prime Day events, Amazon enhanced its live streams with celebrities like Kevin Hart and Miranda Kerr, bolstering viewer engagement. The company has expressed commitment to this format, viewing video shopping as the future of retail and indicating plans for continued investment (Liu 2023). As depicted in Figure 3, Amazon Live’s interface facilitates real-time interactions such as following streamers and engaging through likes, shares, and comments, thereby enriching the shopping experience. These features underscore LSC’s unique advantage of live social interaction, distinguishing it from traditional retail (Wade and Shan 2021).

Figure 3: Amazon live’s website (left) and app (right) featuring interactive functionalities such as a chat box

Source: Amazon

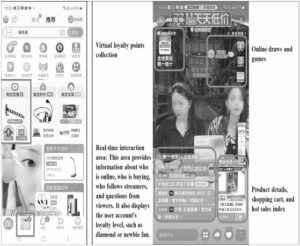

Taobao has adopted a more proactive stance in LSC than Amazon, enhancing the user interface with greater interactivity. Figure 4 illustrates Taobao’s 2023 interface update, which prominently features live streaming on the main shopping app’s central navigation. Users can enter live sales events from the middle-left section of the homepage, and there’s an area for combined live sales and short video entertainment – reminiscent of TikTok – at the bottom. Taobao’s interactive offerings, including online draws, games, a loyalty points system, and a sales trend index, surpass Amazon’s. It boasts a social media-like interface for live interactions, displaying active participants, current purchases, follower updates, and streamer interactions, with a user loyalty ranking system from „newbie fan“ to „diamond“ status. Chinese platforms merge commerce with social interaction and entertainment, yielding a dynamic user experience. This differs from Western platforms such as Amazon, which focus on efficiency over entertainment. Chinese platforms’ blend of commerce and fun offers a fresh model for Western online retail revitalization (Wade and Shan 2021; Whitler 2019).

Figure 4: Taobao app’s integration of LSC on the main page (left), and the rich interactive design and content of the live stream page (right)

Source: Taobao

Customers on e-commerce platforms have a strong inclination for online shopping, often preferring to purchase through these channels due to the convenience of stored payment and shipping details, which enhances the likelihood of impulsive buys and higher sales conversion rates (Xue and Liu 2022). The design of these platforms, focusing on products and purchasing processes, fosters an environment conducive to in-depth product demonstrations. However, these commercially oriented platforms may not attract as large an audience as social media sites like Facebook or TikTok, potentially limiting their reach. To thrive on these LSC platforms, streamers must highlight competitive pricing and the unique features of their products.

3.1.2 LSC on short-form videos platforms

On August 15, 2023, the co-branded wine launch by NBA star James Harden on Chinese TikTok witnessed a rapid sell-out, with 10,000 bottles purchased almost instantaneously. This event was significantly bolstered by the involvement of prominent TikTok influencer “Crazy Little Brother Yang” and Harden’s own appearance, contributing to the immediate sell-out (Matthews 2023). This event showcased TikTok’s live sales model: driving sales by first creating engaging content. TikTok excel in delivering tailored video content, which keeps users engaged and entertained (Rach and Peter 2021).

In the West, TikTok has surpassed YouTube in user engagement, as per Lebow (2022), leading to an increase in short-form video platforms incorporating commercial ads and live sales. This trend, initiated by TikTok and subsequently adopted by Facebook and Instagram’s Reels and YouTube’s Shorts, merges interactive shopping with compelling content, a concept TikTok terms „Shoppertainment“ (Murray 2023). By utilizing algorithm-driven recommendations, this approach simplifies the shopping process, obviating the need for manual product searches (Nelson 2022)

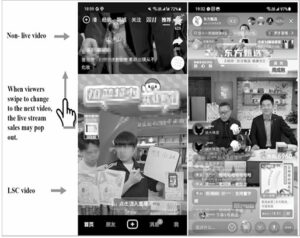

Figure 5 showcases TikTok’s integration of live sales within its app interface. Users can seamlessly transition from casual browsing to engaging with live sales content, which is interspersed among various video types to captivate interest. Echoing Taobao’s interactive style, TikTok enriches its live sales area with engaging and gamified elements. The right-side image presents EastBuy as an illustrative example of TikTok’s model characteristics. As an innovative live sales company backed by a leading English education brand in China, EastBuy uniquely integrates English education with product sales, creating a distinctive and engaging narrative for its sales approach.

While short-form video platforms captivate audiences with their content, not all viewers are inclined to shop (Xue and Liu 2022). Therefore, live sales engagement and conversion rates may trail behind transaction-centric platforms. Success for streamers hinges on creating content that instantly resonates with viewers’ interests. TikTok’s algorithm optimizes content visibility based on user preferences over mere follower counts, which is particularly beneficial for streamers without large followings to amplify their reach (Chen and Shi 2022).

Figure 5: The TikTok app engages viewers with Live Shopping Content (LSC) while swiping through videos (left) and features an interactive LSC interface design (right)

Source: TikTok

3.1.3 LSC on social network platforms

Platforms like Facebook and Instagram, designed to nurture interpersonal connections, offer a variety of tools for sharing images, text, and videos. These platforms have a broad international user base and sophisticated backend systems that map out complex user relationship networks, essential for the viral spread of information (Krah and Miklošík 2022). In the U.S., Facebook is preferred over Amazon for live sales due to its rich content and social interaction, leading to better user retention. Excluding China, Facebook is the top choice for live sales globally (Bazaarvoice 2022).

Facebook provides a dynamic and interactive environment for live streaming, enhancing streamer-viewer connections, unlike typical e-commerce platforms. It introduced Facebook Live in 2016, making streaming accessible to all users and adding features for real-time reactions such as “Love,” “Haha,” among others (fb 2016). To align with the LSC trend, Facebook Shops was launched in 2020 to facilitate live sales (fb 2020). Petco’s event on Facebook showcased this capability, increasing brand visibility for YOULY and Reddy, doubling the return on ad spend, achieving a 62% conversion rate for online sales, and facilitating dog adoptions (fb 2023).

Figure 6: The live stream of renowned Taiwanese live streamer, Ban Mei, on Facebook’s website in Taiwan

Source: Facebook

Social platforms like Facebook focus on interactive content through community building, distinctive branding, authentic interactions, and collaborations with influencers (Chen and Shi, 2022). However, these platforms encounter challenges, such as audiences not primarily focused on shopping and the requirement for third-party transactional software, due to the lack of integrated shopping carts, customer databases, and logistics systems. While Facebook excels in attracting viewers and disseminating information, it relies on external links for transaction processing. Users are directed to either specific brand e-commerce sites or third-party systems to complete purchases. For instance, Figure 6 showcases Taiwanese streamer Ban Mei’s Valentine’s Day 2023 live stream on Facebook, which drew 1.45 million views and substantial engagement. Interestingly, comments were used for placing orders, with specific keywords like “XXX+1” signifying product requests. These keywords are utilized by third-party systems to process orders, circumventing the need for traditional e-commerce features like shopping carts and checkouts.

Table 1 compares the advantages, disadvantages, and key business challenges for streamers within each of the three types of LSC platforms.

| Types | Example | Advantages | Disadvantages | Challenges |

|---|---|---|---|---|

| E-commerce | Amazon, Taobao | - High conversion | - Closed-off nature | - Product & price competition |

| - Shopping-focused | - Smaller user base | |||

| - Ready buyer data | - Low traffic | |||

| Short-form video | TikTok | - High traffic | - Casual shoppers | - Video content appeal |

| - Video viewers | - Lower conversion | - Balancing entertainment & selling | ||

| - Fun content | ||||

| Social network | - Social tools | - No shopping cart | - Quick engagement | |

| - Global reach | - Lower sales & completions | - Address user issues | ||

| - Viral potential | - Tough data management | - Seamless integration of transactions |

Table 1: A comparison of LSC platforms

Source: Author

3.2 Supply side: Collaborative dynamics in content and product supply

A typical LSC supply chain comprises three pivotal actors: streamers, suppliers, and MCNs – the latter acting as streamer agencies. L’Oréal’s LSC venture in China exemplifies these roles. As an LSC trailblazer, L’Oréal joined forces with MCN company, Beauty One in 2016, fostering Beauty Advisors who thrived in live stream sales on Taobao and doubled as physical counter staff. These advisors evolved into brand ambassadors and influential online sellers, with some, like “Lipstick King” Jiaqi Li, achieving immense social fame – Li once sold 15,000 L’Oréal lipsticks in five minutes. Such feats have spurred L’Oréal to ramp up its LSC initiatives (Business Insider 2021).

In 2020, L’Oréal held over 6000 events both online and in-store during key sales periods. These events contributed to more than 10% of its annual sales in China (Wang and Yolo 2022). L’Oréal’s approach of transforming Beauty Advisors into streamers allowed them to multitask as audience builders, endorsers, and social media curators, significantly boosting promotional outreach (Campbell and Farrell 2020). This blended retail strategy vaulted L’Oréal to the top of Taobao’s sales charts during the Double 11 promotion in 2022, with L’Oréal and Lancôme making $385 million and $247 million, respectively (Dudarenok 2023). L’Oréal promotes its “e-advisors” model, offering instant responses and customized counsel, as a trust-building tool through social media. This model, initiated in China, is now being adopted globally, with activities on various digital platforms (L’Oréal 2020).

MCNs, another key supply side entity, link brands with streamers. They handle a gamut of tasks including coordination, recruitment, content curation, ad placement, negotiation, analytics, and ensuring flawless live sales execution. Originating from YouTube, MCNs have expanded their service offerings to content creators (Gardner and Lehnert 2016). While not mandatory for all LSC operations, their role is crucial for large, complex brand campaigns.

Product suppliers, like L’Oréal, are tasked with providing promotional resources, managing inventory, and upholding quality standards to meet the demands of live sales. They often manage logistics, shipping products directly to consumers, allowing MCNs and Streamers to prioritize content creation and sales activities.

Streamers are essential for producing content and engaging audiences, requiring adept improvisational abilities. They take on various roles, and as Xue and Liu (2022) note, can be divided into two categories based on their online presence: influencers, including key opinion leaders and celebrities, and non-influencers, comprising niche experts and corporate heads. Influencers generally achieve higher sales conversions and increase brand visibility but come with higher costs due to fixed commissions for live sales. In contrast, non-influencers carry lower costs and also, typically, lower conversion rates and brand impact, necessitating a calculated approach to leverage their advantages.

3.3 Demand side: Consumer drive by discovering deals and experiencing excitement

Surveys show the main motivations for U.S. consumers engaging in livestream shopping in 2021 included seeking deals (39.7%), discovering new products (38.2%), learning about products (36.6%), and enjoying the excitement of buying (30.7%) (Chevalier 2022b). McKinsey reports entertainment and fun as top reasons for American and European LSC use, with price benefits as a secondary factor (Becdach et al. 2023). This implies a need for engaging experiences in shopping, likely due to the monotony of traditional e-commerce for Gen Z and younger Millennials (Robertson 2022).

Compared to traditional e-commerce, which prioritizes convenience, product types, and price (Chiang and Dholakia 2003), LSC uniquely offers product discovery and an exhilarating experience. Its live interaction and visual demos provide transparent, detailed insights into products, with immediate responses and personalization, surpassing language and textual comprehension barriers. This enriches understanding of new products. LSC’s dynamic presentations and features like likes, gifts, games, coupons, flash offers, and raffles create an exciting shopping experience.

Studies reveal LSC’s key elements are interactivity, community, and shared interests, similar to watching a major event, validating purchasing decisions (Robertson 2022). Consumers in LSC not only shop but gain social visibility, earning social capital by participating in these innovative events and forming new connections through shared interests, facilitated by algorithms that unite like-minded individuals (Robertson 2022).

3.4 Algorithm’s role in LSC: Enhancing content relevance and user engagement

The algorithm, essential yet often overlooked in LSC research, is embedded within its ecosystem, impacting stakeholders, information flow, and transactions. It sets LSC apart from other retail models. Unlike traditional e-commerce, where SEO and advertising dictate product visibility, LSC algorithms focus on video content relevance and live engagement, valuing more than just follower counts (Rach and Peter 2021). These algorithms not only enhance the visibility of sales events but also tailor content to viewer profiles, engagement, motivations, and digital behaviors, acting as digital orchestrators of content and interaction (Chen and Shi 2022). They utilize notifications, user interests, and interactions to expand content reach and adapt target audiences, marking LSC as distinctively interactive compared to traditional retail models (Chen and Shi 2022).

4 Implications from the LSC framework

Our study’s framework highlights the unique characteristics of Live Stream Commerce (LSC) compared to traditional retail models, providing practical insights for future research. The first aspect is innovating value creation and enhanced experiences. LSC excels in meeting consumer needs and offering unparalleled retail experiences by integrating transactional functions, media features, and social connectivity, creating a content-focused, experiential, and network-driven retail model (Murdoch et al. 2022).

The second aspect is embracing decentralization and Direct-to-Consumer (D2C) trends. LSC marks a shift towards decentralization, allowing brands to directly connect with customers, reducing costs and risks, and leveraging data for personalized experiences (Hinterhuber 2022).

Thirdly, LSC utilizes algorithmic analysis and community engagement. It combines data analysis with community dynamics, enabling targeted marketing and enhanced customer interactions, where individual preferences significantly influence others’ purchasing decisions.

Lastly, LSC provides a cost-effective platform for rapid expansion and sales. It’s an economical, low-risk platform for immediate sales, requiring minimal investment and offering quick ROI through effective viewer-to-buyer conversions (Robertson 2022). LSC is adaptable to consumer demands, utilizing targeted algorithms for customer satisfaction and achieving higher conversion rates than traditional retail (Arora et al. 2021). It’s especially attractive to younger audiences, offering innovative shopping experiences (Murdoch et al. 2022).

5 Future research agendas

Based on the frameworks proposed in this research, future studies could explore the directions explained in next chapters.

5.1 Comparative platform studies

Comparative studies analyzing consumer psychology and behavior across LSC’s three main platform categories – e-commerce, short-form video, and social networks – can offer critical insights (Sun et al. 2019). Users likely approach these platforms with fundamentally different mindsets and motivations, significantly impacting their live shopping journey (Xue and Liu 2022). For instance, e-commerce platforms attract audiences already inclined towards transactions, while social platforms draw users seeking entertainment and connections. Quantitatively mapping differences in time spent, touchpoints, and completion rates across platform types through customer journey analysis could reveal variations pointing to distinct user psychologies (Robertson 2022). Developing an in-depth understanding of how purpose-driven platform positioning shapes user motivations and behaviors provides an invaluable foundation for constructing accurate theoretical models of live shopping. Platform-specific findings would carry important implications for streamer strategies and brand initiatives. Ultimately, recognizing LSC platforms’ intrinsic differences allows research to move beyond homogenized perspectives and generate findings with greater real-world relevance.

5.2 Marketing strategies for diverse LSC platforms

LSC platforms have intrinsically different purposes, features, and audiences, brands require tailored strategies to effectively harness each platform’s uniqueness. Comparative research identifying ideal product promotion approaches, influencer partnerships, content balancing, branding, interface design, and performance tracking for e-commerce, short-form video, and social sites can offer invaluable intelligence (Shi 2021). Rather than a one-size-fits-all approach, brands need bespoke playbooks detailing how to capitalize on the distinct marketing possibilities within each platform based on its transactional or entertainment orientation (Robertson 2022). Uncovering the platform-specific strategies that maximize engagement and conversions transforms LSC’s potential into measurable gains. With in-depth understanding of how audience motivations vary across platform categories, brands can seamlessly match targeted initiatives to the right platforms (Mai, Sheikh Ahmad and Xu 2023). This research agenda provides roadmaps guiding brands to execute platform-optimized LSC campaigns that outperform standardized efforts.

5.3 Algorithm research in the LSC domain

The algorithms powering LSC platforms are primary orchestrators impacting content visibility, engagement, and recommendations (Chen and Shi 2022). They utilize various metrics like profiles, influencers, and interactions to optimize live stream prominence and suggestions. Through reverse engineering, researchers can unravel how these algorithms value different factors to decipher the engagement and success formula for each platform. Understanding the core drivers of algorithmic rankings empowers streamers to refine strategies and brands to maximize LSC effectiveness. Additionally, algorithms represent a key point of differentiation between platform categories, meriting comparative analysis. For example, e-commerce sites may prioritize product relevance, while short-form video platforms emphasize entertainment value (Rach and Peter 2021). Mapping algorithms’ embedded priorities and logic provides actionable intelligence for stakeholders seeking to thrive on specific LSC platforms amid intense competition (Kočišová and Štarchoň 2023). Ultimately, demystifying the algorithms shaping user experiences and streamer success offers data-driven guidance for tactical optimization across the LSC ecosystem (Chen and Shi 2022).

5.4 Supply chain partnerships and models

Major LSC initiatives involve meticulous coordination between brands, MCNs, and streamers across areas like inventory, logistics, and data. While surface-level LSC operations appear straightforward, the complex back-end supply chains enabling seamless execution warrant deeper investigation (Xue and Liu 2021). Through case studies and interviews, researchers can map out best practices for establishing roles, workflows, contracts, and data sharing to smooth LSC delivery. Legal considerations around partnerships, commissions, and data control are also salient to explore. Overall, illuminating the ingredients for effective LSC supply chain integration provides implementable frameworks for brands seeking to maximize campaign success (Robertson 2022). Research focused on real-world collaborations can convert abstract LSC theory into actionable intelligence guiding supply chain relationship building, infrastructure design, and executional excellence.

5.5 Cross-cultural research

As LSC gains global prominence, comparative research between Asian and Western markets provides useful international insights (Wade and Shan 2021). Investigating how cultural orientations shape consumer perceptions and behaviors could explain regional platform preferences. For instance, Asian consumers may favor entertainment-focused platforms while Westerners gravitate towards direct shopping options (Whitler 2019). Testing theoretical models like Hofstede’s cultural dimensions in relation to LSC adoption allows researchers to determine which aspects are culturally-bound versus universal. Over time, mapping cross-national differences and similarities can guide global branding and localization strategies. Cross-cultural studies also enable knowledge transfer, where lessons from mature LSC markets inform emerging markets. Ultimately, developing cultural fluency regarding LSC paves the way for nuanced strategies and impactful theoretical advancements (Wade and Shan 2021).

5.6 LSC’s long-term impacts

While current LSC research analyzes immediate consumer responses, longitudinal studies tracking changes over extended periods can reveal LSC’s lasting footprints (Ployhart and Vandenberg 2010). Through long-term data collection via surveys, ethnography, and data mining, researchers can monitor shifts in brand relationships, shopping habits, and retail expectations. As LSC becomes embedded in consumer lifestyles, how might loyalty and engagement transform? Will behaviors like showrooming increase? Such findings offer strategic foresight for brands seeking to capitalize on LSC’s influences before competitors. Tracing the customer journey through its evolutionary stages paints a holistic picture of LSC’s gradual, cumulative effects. Longitudinal observations also enable researchers to test theoretical models over lifecycles rather than cross-sectional snapshots (Rindfleisch et al. 2008). Ultimately, long-term tracking of LSC’s consumer and industry impacts provides indispensable insights to guide strategy amid an era of retail disruption.

Literatúra/List of References

- AliResearch, 2018. Inside China-Taobao CEO: Two things promoting retail development. 2018. [online]. [cit. 2024-02-10]. Available at: <https://xueqiu.com/1527849020/117761695/>

- Arora, A., Glaser, D., Kluge, P., Kim, A., Kohli, S. and Sak, N., 2021. It’s showtime! How live commerce is transforming the shopping experience. McKinsey, 2021. [online]. [cit. 2024-02-10]. Available at: <https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/its-showtime-how-live-commerce-is-transforming-the-shopping-experience>

- Bazaarvoice, 2023. Social shopping survey, 2023. [online]. [cit. 2024-02-10]. Available at: <https://www.statista.com/statistics/1346066/social-media-purchases-live-streaming-worldwide/>

- Becdach, C., Glaser, D., Sak, N., Wang, K. W. and Zimmermann, S., 2023. Ready for prime time? The state of live commerce. McKinsey, 2023. [online]. [cit. 2024-02-10]. Available at: <https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/ready-for-prime-time-the-state-of-live-commerce#/>

- Becdach, C., Kubetz, Z., Nakajima, J., Gersovitz, A., Glaser, D. and Magni, M., 2022. Social commerce: The future of how consumers interact with brands. McKinsey, 2022. [online]. [cit. 2024-02-10]. Available at: <https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/social-commerce-the-future-of-how-consumers-interact-with-brands#/>

- Business Insider, 2021. Meet China’s ‘lipstick king’. 2021. [online]. [cit. 2024-02-10]. Available at: <https://www.businessinsider.com/austin-li-jiaqi-chinas-lipstick-king-online-shopping-taobao-2021-3>

- Campbell, C. and Farrell, J. R., 2020. More than meets the eye: The functional components underlying influencer marketing. In: Business Horizons. 2020, 63(4), 469-479. ISSN 0007-6813.

- CCPIT (Academy of China Council for the Promotion of International Trade), 2022. Users of live streaming e-commerce increase. 2022. [online]. [cit. 2024-02-10]. Available at: <https://www.chinadaily.com.cn/a/202211/24/WS637edee8a31049175432ba87.html>

- Chen, C. and Zhang, D., 2023. Understanding consumers’ live-streaming shopping from a benefit-risk perspective. In: Journal of Services Marketing. 2023, 37(8), 973-988. ISSN 0887-6045.

- Chen, C. D., Zhao, Q. and Wang, J. L., 2022. How livestreaming increases product sales: role of trust transfer and elaboration likelihood model. In: Behaviour & Information Technology. 2022, 41(3), 558-573. ISSN 0144-929X.

- Chen, H., Zhang, S., Shao, B., Gao, W. and Xu, Y., 2022. How do interpersonal interaction factors affect buyers’ purchase intention in live stream shopping? The mediating effects of swift guanxi. In: Internet Research. 2022, 32(1), 335-361. ISSN 1066-2243.

- Chen, Z. and Shi, C., 2022. Analysis of algorithm recommendation mechanism of TikTok. In: International Journal of Education and Humanities. 2022, 4(1), 12-14. ISBN 2616-4819.

- Chevalier, S., 2022a. Live commerce – statistics & facts. 2022. [online]. [cit. 2024-02-10]. Available at: <https://www.statista.com/topics/8752/livestream-commerce/#topicOverview>

- Chevalier, S., 2022b. Leading reasons to shop in livestreams among consumers in the United States in 2021. 2022. [online]. [cit. 2024-02-10]. Available at: <https://www.statista.com/statistics/1276308/shopping-reasons-livestreams-us/>

- Chiang, K. P. and Dholakia, R. R., 2003. Factors driving consumer intention to shop online: an empirical investigation. In: Journal of Consumer Psychology. 2003, 13(1-2), 177-183. ISSN 1057-7408.

- Diedrich, M., 2017. Study: The use of social media for service delivery: How do end-users use customer service 2.0? In: Marketing Science & Inspirations. 2017, 12(2), 2-11. ISSN 1338-7944.

- Dudarenok, A., 2023. China e-commerce, marketing & digital space 2023. [online]. [cit. 2024-02-10]. Available at: <https://chozan.co/wp-content/uploads/2023/03/China-Ecommerce-Marketing-and-Digital-Space-2023.pdf>

- Fb, 2016. Introducing new ways to create, share and discover live video on Facebook. 2016. [online]. [cit. 2024-02-10]. Available at: <https://about.fb.com/news/2016/04/introducing-new-ways-to-create-share-and-discover-live-video-on-facebook/>

- Fb, 2020. Introducing Facebook shops: helping small businesses sell online. 2020. [online]. [cit. 2024-02-10]. Available at: <https://about.fb.com/news/2020/05/introducing-facebook-shops/>

- Fb, 2023. Petco: Boosting sales with Facebook live shopping. 2023. [online]. [cit. 2024-02-10]. Available at: <https://www.facebook.com/business/success/petco>

- Gao, W., Liu, Y., Liu, Z. and Li, J., 2018. How does presence influence purchase intention in online shopping markets? An explanation based on self-determination theory. In: Behaviour & Information Technology. 2018, 37(8), 786-799. ISSN 0144-929X.

- Gardner, J. and Lehnert, K., 2016. What’s new about new media? How multi-channel networks work with content creators. In: Business Horizons. 2016, 59(3), 293-302. ISSN 0007-6813.

- Guo, L., Hu, X., Lu, J. and Ma, L., 2021. Effects of customer trust on engagement in live streaming commerce: Mediating role of swift guanxi. In: Internet Research. 2021, 31(5), 1718-1744. ISSN 1066-2243.

- Hallanan, L., 2019. Amazon live is Alibaba’s live-streaming without the good bits. Forbes. 2019. [online]. [cit. 2024-02-10]. Available at: <https://www.forbes.com/sites/laurenhallanan/2019/03/15/amazon-live-is-alibabas-live-streaming-without-the-good-bits/#34c56a8f94ab>

- He, D., Yao, Z., Tang, P. and Ma, Y., 2023. Impacts of different interactions on viewers’ sense of virtual community: An empirical study of live streaming platform. In: Behaviour & Information Technology. 2023, 42(7), 940-960. ISSN 0144-929X.

- Hinterhuber, A., 2022. Digital transformation, the Holy Grail, and the disruption of business models: An interview with Michael Nilles. In: Business Horizons. 2022, 65(3), 261-265. ISSN 0007-6813.

- Holman, J. and Huang, K., 2023. The companies trying to make live shopping a thing in the U.S. The New York Times. 2023. [online]. [cit. 2024-02-10]. Available at: <https://www.nytimes.com/2023/05/10/business/live-shopping-us.html>

- Kawulich, B. B., 2005. Participant observation as a data collection method. In: Forum: Qualitative Social Research. 2005, 6(2). ISSN 1438-5627.

- Kočišová, L. and Štarchoň, P., 2023. The role of marketing metrics in social media: A comprehensive analysis. In: Marketing Science & Inspirations. 2023, 18(2), 40-49. ISSN 1338-7944.

- Krah, B. A. and Miklošík, A., 2022. Creating communities: A way of entering foreign markets in 2022. In: Marketing Science & Inspirations. 2022, 17(1), 38-50. ISSN 1338-7944.

- L’Oréal, 2020. The new e-commerce: Social commerce. 2020. [online]. [cit. 2024-02-10]. Available at: <https://www.loreal-finance.com/en/annual-report-2020/digital-4-4-0/the-new-e-commerce-social-commerce-4-4-3/>

- Lebow, S., 2022. TikTok to surpass YouTube in US. Insider intelligence. 2022. [online]. [cit. 2024-02-10]. Available at: <https://www.insiderintelligence.com/content/tiktok-surpass-youtube>

- Li, L., Kang, K., Zhao, A. and Feng, Y., 2023. The impact of social presence and facilitation factors on online consumers’ impulse buying in live shopping-celebrity endorsement as a moderating factor. In: Information Technology & People. 2023, 36(6), 2611-2631. ISSN 0959-3845.

- Liu, T., 2023. TikTok and Amazon bet on China’s ecommerce model. It’s a dud. wired. [online]. [cit. 2024-02-10]. Available at: <https://www.wired.com/story/tiktok-amazon-china-livestream-ecommerce/>

- Mai, X., Sheikh Ahmad, F. and Xu, J., 2023. A comprehensive bibliometric analysis of live streaming commerce: Mapping the research landscape. In: SAGE Open. 2023, 13(4), 21582440231216620. ISSN 2158-2440.

- Matthews, B., 2023. 10,000 bottles of NBA star James Harden’s wine sell in seconds on Chinese version of TikTok. The Washington Times. 2023. [online]. [cit. 2024-02-10]. Available at: <https://www.washingtontimes.com/news/2023/aug/17/10k-bottles-of-nba-star-james-hardens-wine-sell-in/>

- Murdoch, R., Wright, O., Fang Grant, K., Collins, K. and McCracken, L., 2022. Why shopping’s set for a social revolution. Accenture. 2022. [online]. [cit. 2024-02-10]. Available at: <https://www.accenture.com/us-en/insights/software-platforms/why-shopping-set-social-revolution>

- Murray, C., 2023. TikTok clones: How Spotify, Instagram, Twitter and more are copying features like the ‘For You’ page. Forbes. 2023. [online]. [cit. 2024-02-10]. Available at: <https://www.forbes.com/sites/conormurray/2023/03/13/tiktok-clones-how-spotify-instagram-twitter-and-more-are-copying-features-like-the-for-you-page/?sh=2bc986954473>

- Musante, K. and DeWalt, B. R., 2010. Participant observation: A guide for fieldworkers. Rowman Altamira., 2010. ISBN 978-0759111447.

- Nelson, C., 2022. Why and how brands can leverage „Shoppertainment“. Forbes. 2022. [online]. [cit. 2024-02-10]. Available at: <https://www.forbes.com/sites/forbescommunicationscouncil/2022/11/30/why-and-how-brands-can-leverage-shoppertainment/?sh=32ebedc3cf2e>

- Park, H. J. and Lin, L. M., 2020. The effects of match-ups on the consumer attitudes toward internet celebrities and their live streaming contents in the context of product endorsement. In: Journal of Retailing and Consumer Services. 2020, 52, 101934. ISSN 0969-6989.

- Ployhart, R. E. and Vandenberg, R. J., 2010. Longitudinal research: The theory, design, and analysis of change. In: Journal of Management. 2010, 36(1), 94-120. ISSN 0149-2063.

- Rach, M. and Peter, M. K., 2021. How TikTok’s algorithm beats Facebook & co. for attention under the theory of escapism: a network sample analysis of Austrian, German, and Swiss users. In: Advances in Digital Marketing and eCommerce: Second International Conference, Cham: Springer International Publishing, 2021, p. 137-143. ISBN 978-3-030-76520-0.

- Rindfleisch, A., Malter, A. J., Ganesan, S. and Moorman, C., 2008. Cross-sectional versus longitudinal survey research: Concepts, findings, and guidelines. In: Journal of marketing research. 2008, 45(3), 261-279. ISSN 0022-2437.

- Robertson, T. S., 2022. Selling on TikTok and Taobao. In: Harvard Business Review. [online]. [cit. 2024-02-10]. Available at: <https://hbr.org/2022/09/selling-on-tiktok-and-taobao>

- Rosenbaum, M. S., Edwards, K. and Ramirez, G. C., 2021. The benefits and pitfalls of contemporary pop-up shops. In: Business Horizons. 2021, 64(1), 93-106. ISSN 0007-6813.

- Si, R., 2021. China livestreaming E-commerce industry insights. Springer Singapore, 2021. ISBN 978-981-17-7471-4.

- Statista, 2022. Distribution of leading livestreaming e-commerce platforms’ gross merchandise in China in 2021, by platform. 2022. [online]. [cit. 2024-02-10]. Available at: <https://www.statista.com/statistics/1339406/china-market-share-of-leading-live-commerce-platforms/>

- Statista, 2023. Preferred platforms to shop via livestream in the United States in 2022. [online]. [cit. 2024-02-10]. Available at: <https://www.statista.com/statistics/1286498/most-used-live-shopping-apps-us/>

- Sun, Y., Shao, X., Li, X., Guo, Y. and Nie, K., 2019. How live streaming influences purchase intentions in social commerce: An IT affordance perspective. In: Electronic Commerce Research and Applications. 2019, 37, 100886. ISSN 1567-4223.

- Turits, M., 2023. TikTok has major power to move consumers to spend on the products creators feature. Why is the pull so strong? BBC. 2023. [online]. [cit. 2024-02-10]. Available at: <https://www.bbc.com/worklife/article/20230818-why-are-tiktok-creators-so-good-at-making-people-buy-things/>

- Wade, M. and Shan, J., 2021. What the west can learn from China’s live commerce success. MIT Sloan Management Review. 2021. [online]. [cit. 2024-02-10]. Available at: <https://sloanreview.mit.edu/article/what-the-west-can-learn-from-chinas-live-commerce-success/>

- Wang, I. et al., 2022. How L’Oréal uses digital strategy to resist the invasion of new brands. 2022. [online]. [cit. 2024-02-10]. Available at: <https://edu.tencentads.com/Solution/ListDetail/8a46cc02-f5f>

- Whitler, K. A., 2019. What western marketers can learn from. In: Harvard Business Review. 2019, 97(3), 81-88. ISSN 0017-8012.

- Wongkitrungrueng, A. and Assarut, N., 2020. The role of live streaming in building consumer trust and engagement with social commerce sellers. In: Journal of Business Research. 2020, 117, 543-556. ISSN 0148-2963.

- Wongkitrungrueng, A., Dehouche, N. and Assarut, N., 2020. Live streaming commerce from the sellers’ perspective: Implications for online relationship marketing. In: Journal of Marketing Management. 2020, 36(5-6), 488-518. ISSN 0267-257X.

- Xue, J. and Liu, M. T., 2022. Investigating the live streaming sales from the perspective of the ecosystem: the structures, processes and value flow. In: Asia Pacific Journal of Marketing and Logistics. 2022, 35(5), 1157-1186. ISSN 1355-5855.

- Zhang, M., Liu, Y., Wang, Y. and Zhao, L., 2022. How to retain customers: Understanding the role of trust in live streaming commerce with a socio-technical perspective. In: Computers in Human Behavior. 2022, 127, 107052. ISSN 0747-5632.

- Zhang, M., Qin, F., Wang, G. A. and Luo, C., 2020. The impact of live video streaming on online purchase intention. In: The Service Industries Journal. 2020, 40(9-10), 656-681. ISSN 0264-2069.

Kľúčové slová/Key words

live stream commerce, framework, Amazon, Taobao, TikTok, Facebook, algorithm

obchodovanie v priamom prenose, štruktúra, Amazon, Taobao, TikTok, Facebook, algorytmus

JEL klasifikácia/JEL Classification

M31

Résumé

Štruktúrovanie obchodovania v priamom prenose: Štúdia o klasifikácii, vývoji rámca a budúcich výskumných plánoch

Cieľom tejto štúdie je odstrániť existujúce medzery vo výskume Live Stream Commerce (LSC) zameraním sa na pochopenie rôznych platforiem LSC a motivácie a správania používateľov v rámci týchto platforiem. Na dosiahnutie tohto cieľa sa navrhuje praktický a strategický analytický rámec. Tento rámec komplexne skúma klasifikáciu LSC a jeho aspekty ponuky a dopytu, pričom poskytuje podrobný opis jeho javov, charakteristík, účastníkov a prevádzkových metód. Okrem toho táto štúdia identifikuje nové smery výskumu vrátane skúmania správania spotrebiteľov a marketingových stratégií na rôznych typoch platforiem, analýzy vplyvu algoritmov na správanie, skúmania rozdielov vo vývoji LSC medzi východom a západom, skúmania integrácie dodávateľských reťazcov LSC a posudzovania vplyvu LSC na tradičný elektronický obchod. Celkovo je cieľom tohto rámca usmerniť budúce výskumné úsilie, ktoré bude prínosom pre akademikov aj odborníkov z odvetvia.

Recenzované/Reviewed

21. February 2024 / 23. April 2024